Employee Stock Purchase Plan Calculator

Introduction

Employee Stock Purchase Plans (ESPPs) offer employees the opportunity to purchase company stock at a discounted price, fostering a sense of ownership. To simplify the calculation of potential gains, a reliable ESPP calculator becomes invaluable. This article provides insights into the calculator’s construction and usage.

How to Use

The ESPP calculator is designed to be user-friendly. Follow these steps to calculate potential gains:

- Input the Offer Price: Enter the stock’s offering price per share.

- Specify the Discount Percentage: Input the discount percentage offered through the ESPP.

- Enter the Contribution Period: Define the time duration for the ESPP contribution.

- Click Calculate: Press the ‘Calculate’ button to obtain the potential gains.

Formula

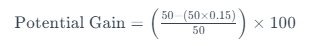

The formula for calculating the potential gain in an ESPP is as follows:

Example

Let’s consider an example:

- Offer Price: $50

- Discount Percentage: 15%

- Number of Shares: 100

\text{Potential Gain} = (42.5) \times 100 = $4250

FAQs

Q: What is an Employee Stock Purchase Plan (ESPP)?

A: An ESPP is a benefit program allowing employees to purchase company stock at a discounted rate, typically through payroll deductions.

Q: Why use an ESPP calculator?

A: The calculator helps employees estimate potential gains based on the offer price, discount percentage, and the number of shares they plan to purchase.

Q: How accurate is the ESPP calculator?

A: The calculator uses a precise formula, providing accurate estimates for potential gains.

Q: Can the ESPP calculator be used for any company’s ESPP?

A: Yes, as long as you have the necessary input values: offer price, discount percentage, and number of shares.

Conclusion

The ESPP calculator is a valuable tool for employees looking to assess the potential gains from participating in an Employee Stock Purchase Plan. By following the simple steps and understanding the formula, individuals can make informed decisions about their stock purchases.