Reverse Loan Calculator Excel

Introduction

Calculators are indispensable tools, aiding us in various computations. One specific type gaining popularity is the Reverse Loan Calculator. In this article, we’ll delve into its functionality, provide a working HTML and JavaScript code, and guide you through its usage.

How to Use

To utilize the Reverse Loan Calculator, follow these simple steps:

- Input the loan amount, interest rate, and loan term.

- Click the “Calculate” button.

- Instantly obtain the reverse calculation result.

Now, let’s explore the formula behind this calculator.

Formula

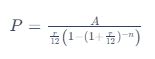

The formula for reverse loan calculation is as follows:

Where:

- P is the loan principal,

- A is the monthly payment,

- r is the monthly interest rate (annual rate divided by 12), and

- n is the total number of payments.

Example

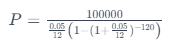

Consider a loan amount of $100,000, an annual interest rate of 5%, and a loan term of 10 years.

The result will provide the initial loan principal.

FAQs

Q1: Can I use this calculator for any type of loan?

Yes, the Reverse Loan Calculator is versatile and applicable to various loan types, including mortgages and personal loans.

Q2: Why is it called a “reverse” loan calculator?

Unlike traditional loan calculators that determine monthly payments, this calculator reverses the process, giving you the initial loan amount based on monthly payments.

Q3: Is the interest rate always in percentage format?

Yes, the interest rate should be entered as a percentage, and the calculator will handle the necessary conversion.

Conclusion

The Reverse Loan Calculator simplifies the process of determining the initial loan amount based on monthly payments. Its formula, example, and user-friendly interface make it a valuable tool for financial planning.